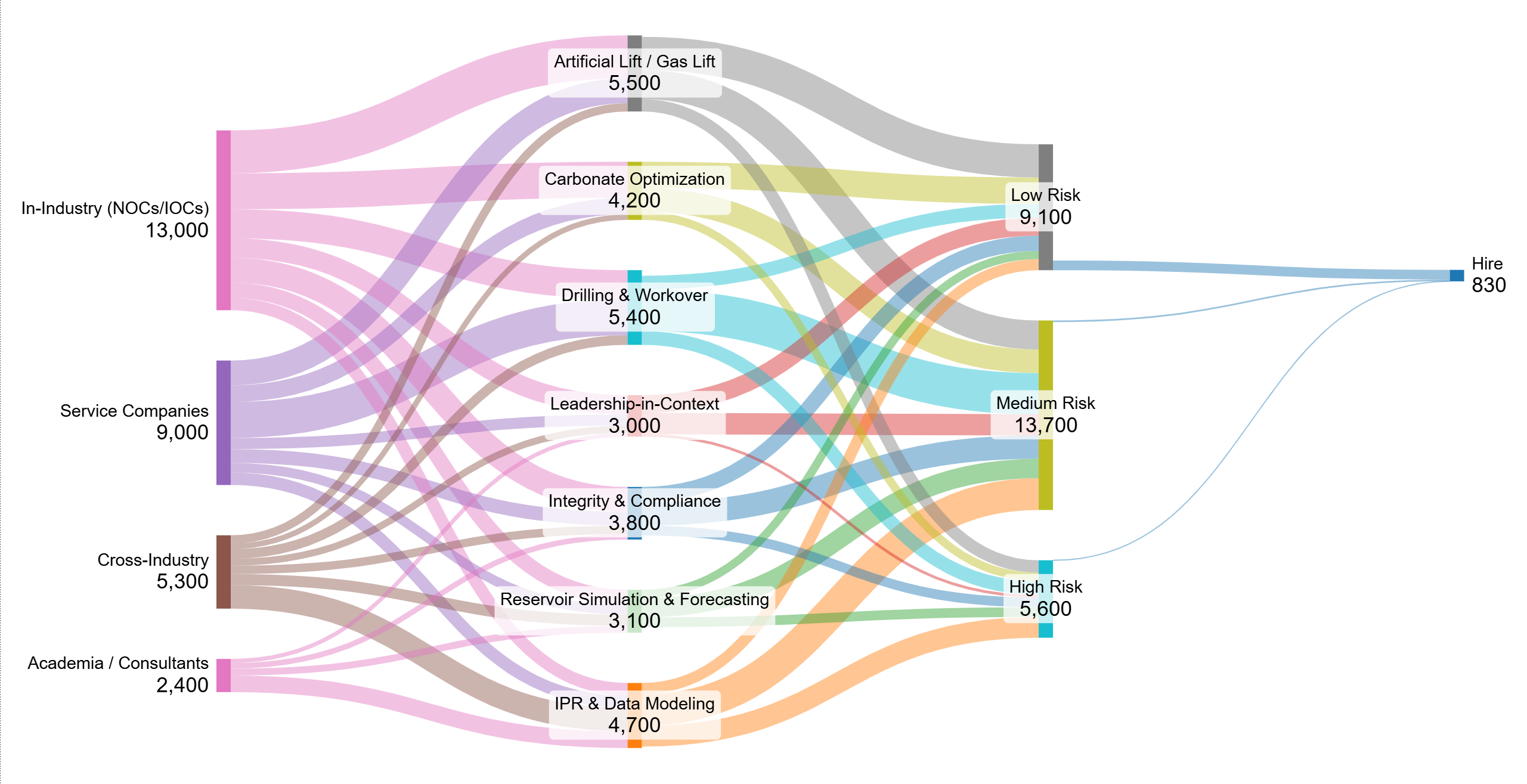

Reducing Hiring Risk in Oil & Gas — Where Low-Risk Talent Really Comes From

This is a market-level view of how candidates compress from broad sources into capability clusters, then into risk bands and, ultimately, hires. The data shows a hard truth: large pipelines rarely translate into low-risk outcomes without integrity depth and leadership anchored to the operating context.

*Sum of source→capability links in the Sankey dataset; hires = 830 (Low-risk 700, Medium 120, High 10).

How to Read the Sankey

The Sankey summarizes the funnel: Sources (in-industry, service, cross-industry, academia) → Capabilities (lift, carbonate optimization, drilling/workover, integrity, IPR, simulation, leadership-in-context) → Risk Bands (Low/Medium/High) → Hires. Width = volume. The sharpest narrowing happens at the risk stage, where integrity depth and contextual leadership determine survivability.

Executive Takeaways

- Conversion is razor-thin: Only 2.8% of flows reach hire. Expect wide top-of-funnel, tight bottom-of-funnel.

- Low-risk dominates hires: 84.3% of hires come from the Low-Risk band; Medium (14.5%) and High (1.2%) contribute marginally.

- Integrity is the swing factor: Barrier ownership and compliance history shift profiles out of Medium-Risk; checklists do not.

- Leadership must be contextual: Asset-specific decision history predicts ramp-up; generic leadership signals don’t compress risk.

- Pairings beat points: Lift systems + integrity, and completions + integrity, outperform single-skill depth in lowering operating risk.

What the Sources Tell Us

In-Industry (NOCs/IOCs)

Strength in Artificial Lift and Carbonate Optimization is evident, but Integrity & Compliance varies by asset maturity and intervention history. Leadership-in-Context appears more frequently here than in other sources—crucial for day-one impact.

Service Companies

Rich supply in Drilling & Workover planning and execution. Risk stays elevated when candidates lack documented barrier ownership (well integrity decisions, not just activity counts). Those who owned KPIs cross into Low-Risk more reliably.

Cross-Industry & Academia

High prevalence of IPR & Data Modeling and Reservoir Simulation. Conversion to Low-Risk improves dramatically when modelers have field exposure to integrity or completions, moving beyond diagnostics into accountable decisions.

Which Capabilities Compress Risk

- Artificial Lift / Gas Lift → Low-Risk channels: 2,400 flows route to Low-Risk vs. 2,100 to Medium and 900 to High. The difference tracks with barrier discipline in mature wells.

- Carbonate Optimization → Predictive advantage: 1,900 Low-Risk vs. 1,700 Medium. Contextual leadership magnifies this edge in offshore carbonates.

- Drilling & Workover → Middle-heavy: 3,000 Medium-Risk dominates; Low-Risk rises only when candidates owned well-barrier criteria and intervention risk.

- Integrity & Compliance → The swing lever: Converts 1,100 to Low-Risk; without ownership, 1,700 remain Medium and 700 High.

- IPR & Data Modeling → Diagnostic accelerator: 2,300 Medium and 1,500 High unless paired with completions/integrity.

- Reservoir Simulation & Forecasting → Similar to IPR: 1,400 Medium and 700 High; Low-Risk remains the minority (600) without operational accountability.

- Leadership-in-Context → Outsize impact: 1,300 Low-Risk, only 200 High. Context is the discriminant—not leadership in general.

Capability Pairings That Lower Operating Risk

- Lift Systems + Integrity: Reduces incident probability on mature assets; correlates with faster stabilization post-intervention.

- Completions + Integrity: Closes the most common failure mode—barrier gaps during workovers and recompletions.

- Carbonate Optimization + Contextual Leadership: Improves decision latency in tight HSE envelopes offshore.

- IPR Modeling + Completion Planning: Converts diagnostics into reliable action; reduces oscillation between models and field.

- Simulation + Integrity: Forecasts translate to safe work sequences when barrier ownership is explicit.

Common Failure Modes to Watch

- Integrity as a checklist: Candidates list standards but can’t evidence barrier decisions—risk stays Medium/High.

- Generic leadership hires: Good people managers, weak asset-specific judgment—ramp-up lags, decisions stall.

- Model-heavy profiles without ownership: Strong diagnostics, low impact on uptime; hand-offs degrade outcomes.

- Service-to-Operator without KPI bridge: Activity counts ≠ accountability; demand KPI-tied stories.

Leading Indicators to Track Next Quarter

How to use them: If Low-Risk hires fall below ~80% share, or total conversion deviates far from ~3%, inspect calibration—either your checkpoints under-weight integrity/context, or sourcing is misaligned with capability needs.

Benchmarks & Ratios From This Dataset

- Total flows: 29,700 (sum of source→capability links).

- Total hires: 830 → 2.8% conversion (830 ÷ 29,700).

- Hire mix by risk band: Low-Risk 84.3% (700), Medium 14.5% (120), High 1.2% (10).

- Middle-heavy domains: Drilling & Workover, IPR, Simulation—require integrity/completions pairing to shift down-risk.

- Low-Risk engines: Lift Systems, Carbonate Optimization, Leadership-in-Context—when coupled with barrier ownership evidence.